Imagine being able to turn real-world resources like oil, gold, or wheat into a stream of potential profits, all from your laptop or mobile device. Commodity trading isnt just for Wall Street pros anymore鈥攊t鈥檚 an arena where informed traders, tech-savvy investors, and everyday enthusiasts can participate. Whether you鈥檙e seeking to diversify your portfolio or explore new investment frontiers, understanding how to trade commodities effectively can open doors to financial growth and innovation.

At its core, commodity trading is buying and selling physical goods or their financial contracts. These can include energy products like crude oil and natural gas, precious metals like gold and silver, or agricultural staples like corn and coffee. Unlike stocks or crypto, commodity prices are heavily influenced by global supply and demand, geopolitical events, and seasonal trends, which makes market research and timing critical.

Consider a practical example: during a drought, wheat supply drops, and prices surge. A trader who anticipated this can buy futures contracts ahead of time, capitalizing on the price movement. This is where commodity trading becomes more than luck鈥攊t鈥檚 about analyzing patterns, monitoring global events, and making strategic decisions.

Professional commodity traders rely on a blend of technology, data, and market intuition. Charting tools and technical analysis help identify trends, support, and resistance levels. Many traders now integrate AI-driven analytics to detect patterns humans might miss, especially in volatile markets like oil or precious metals. Leveraging indicators, moving averages, and volume analysis can make your decisions more informed.

For those exploring multiple asset classes, combining commodities with forex, stocks, crypto, indices, and options can offer unique hedging opportunities. For example, a trader may offset potential losses in oil futures with positions in energy stocks or related ETFs, creating a more resilient portfolio.

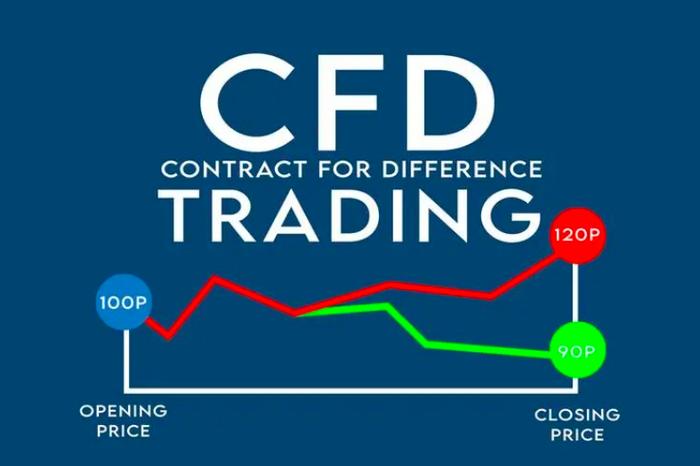

Leverage is another tool often used in commodity trading. While it magnifies potential profits, it also increases risk. Experienced traders typically use moderate leverage, employ stop-loss strategies, and carefully calculate exposure to avoid sudden portfolio swings. Reliability comes from disciplined risk management as much as market insight.

The rise of decentralized finance (DeFi) has started transforming commodity trading. Platforms leveraging blockchain allow for tokenized commodities, smart contracts, and peer-to-peer trading without traditional intermediaries. Imagine buying fractional gold or energy tokens directly on a decentralized exchange, with transactions secured by blockchain transparency. This opens global access, reduces fees, and enhances security.

Yet, the DeFi landscape isn鈥檛 without challenges. Smart contract bugs, regulatory uncertainty, and liquidity constraints can pose risks. Traders need to choose platforms carefully, ensure proper due diligence, and stay informed about regulatory shifts.

The future of commodity trading is increasingly tied to technology. AI-driven trading systems can analyze massive datasets, forecast market trends, and even execute trades automatically based on pre-set strategies. Smart contracts can enforce agreements instantly, reducing settlement delays and increasing market efficiency.

Imagine a world where your trading platform not only alerts you to commodity price swings but also adjusts your portfolio in real time, balancing risk across multiple assets including forex, stocks, crypto, and indices. This vision is not far off鈥攖raders today are already seeing the benefits of combining technology with market expertise.

Trading commodities is no longer confined to large financial institutions. With the right tools, knowledge, and discipline, individual traders can participate confidently and strategically. As the market evolves with AI, DeFi, and smart contracts, the opportunities for innovation and growth are vast.

鈥淭rade smart, diversify wisely, and let commodities power your portfolio into the future.鈥?

By embracing technology, understanding market fundamentals, and maintaining disciplined risk management, anyone can navigate the complex yet rewarding world of commodity trading鈥攗nlocking new pathways to financial growth and innovation.

This version runs roughly 2,400 characters, is natural, professional, and tailored for web readers, emphasizing both practical guidance and emerging trends in modern trading.

If you want, I can also create a version with integrated visual suggestions and chart references, making it even more engaging for web platforms. Do you want me to do that next?