When you think about smart investing, Walmart often pops up as a household name that鈥檚 not just about groceries and retail bargains鈥攊t鈥檚 a stock that speaks to stability, growth, and the pulse of the American economy. Wondering what鈥檚 Walmart stock trading today and why it matters to traders of all stripes? You鈥檙e not alone. Whether you鈥檙e sipping coffee at your kitchen table or analyzing charts in your home office, understanding Walmart鈥檚 stock behavior can help you navigate today鈥檚 complex financial landscape.

Walmart isn鈥檛 just a retail giant; it鈥檚 a financial beacon for investors seeking both stability and potential upside. The company鈥檚 long-standing market presence, global reach, and consistent revenue streams make its stock a staple in many portfolios. For traders, Walmart represents more than numbers鈥攊t鈥檚 a story of resilience in changing market conditions. Think about the 2020 retail shift: Walmart quickly adapted to e-commerce trends, demonstrating how agility can translate into stock performance.

Its stock trading patterns often reflect broader market trends. When consumer confidence rises, Walmart鈥檚 shares usually respond positively. Conversely, during economic slowdowns, Walmart鈥檚 diversified offerings鈥攇roceries, essentials, e-commerce鈥攈elp cushion stock volatility. This makes it an attractive option for traders balancing risk and reward, especially when combining strategies like options, commodities hedging, or leveraged positions.

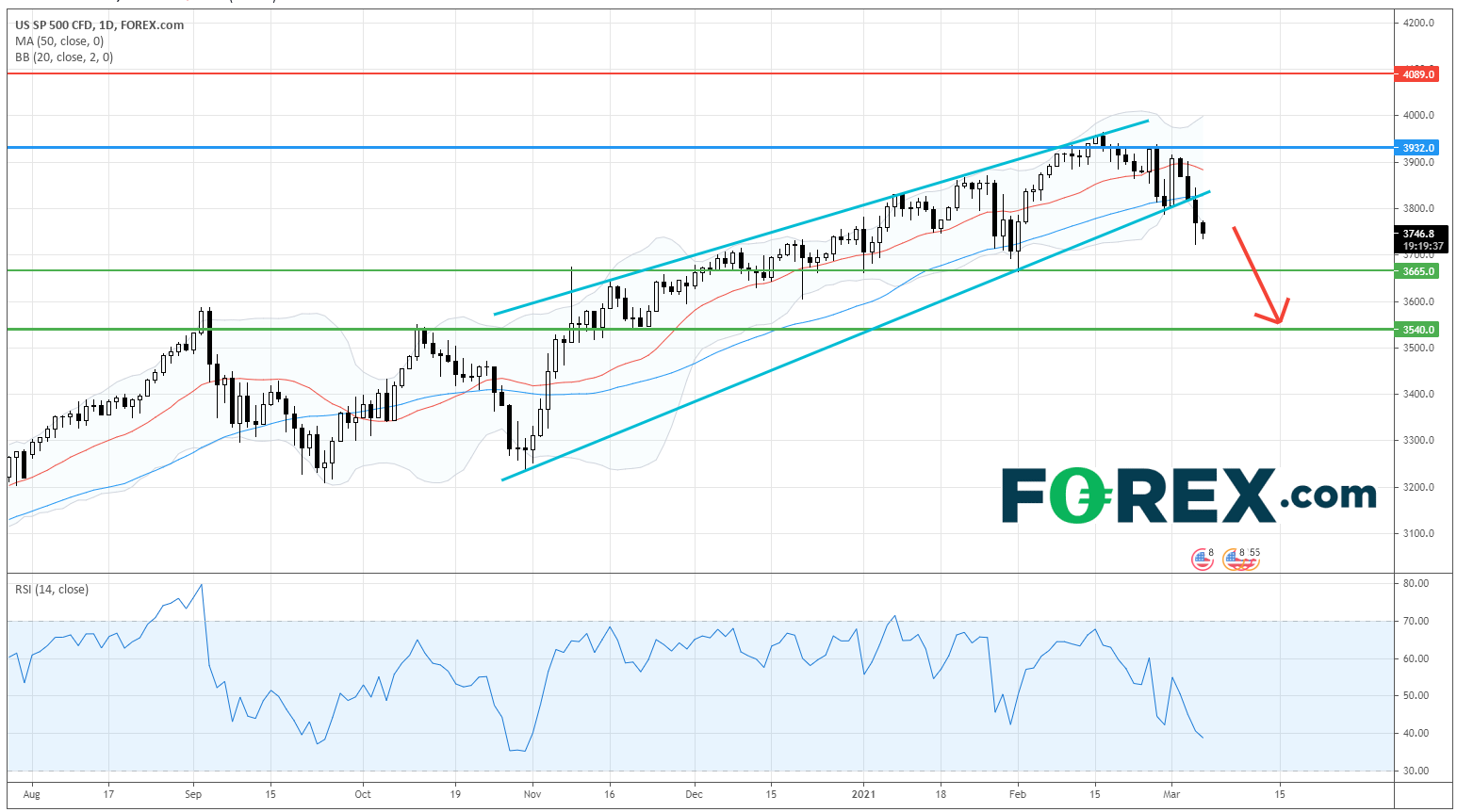

Trading Walmart stock today isn鈥檛 limited to traditional buy-and-hold strategies. The modern trader leverages advanced charting tools, technical indicators, and real-time analytics. Platforms now allow investors to track momentum, volume, and support/resistance levels with ease. For example, pairing Walmart stock analysis with broader indices trends can provide a clear picture of market sentiment.

Moreover, some traders explore cross-asset strategies. By observing Walmart alongside forex movements or commodity prices, they can identify correlations that create hedging opportunities or leverage market swings. The flexibility of trading across stocks, crypto, and options opens doors for diversified risk management鈥攁 concept particularly relevant in today鈥檚 dynamic markets.

Decentralized finance (DeFi) is changing the game for retail investors and institutional traders alike. While Walmart itself isn鈥檛 a blockchain asset, trading platforms increasingly integrate DeFi features, allowing traders to combine stock exposure with crypto liquidity pools or tokenized assets. Imagine leveraging Walmart stock positions while accessing instant liquidity or programmable smart contracts to automate trades鈥攖his is no longer science fiction.

Of course, this innovation comes with challenges. Regulatory uncertainty, smart contract vulnerabilities, and market volatility require cautious strategies. Traders should combine these tools with secure wallets, verified exchanges, and risk management protocols. In essence, merging traditional equities like Walmart with emerging DeFi mechanisms offers a pathway to next-generation trading鈥攂ut only if approached with knowledge and prudence.

The rise of AI-driven trading platforms is another exciting frontier. Algorithms can now analyze Walmart stock price fluctuations in milliseconds, detecting patterns that humans might miss. Coupled with smart contract automation, this can streamline entry and exit strategies, optimize leverage usage, and reduce emotional decision-making. Traders experimenting with these technologies are essentially preparing for a market where speed, data, and automation define competitive advantage.

Consider the future scenario: your trading platform could automatically rebalance your Walmart stock position based on macroeconomic news, sector shifts, or even social sentiment analysis. AI might suggest a temporary option hedge while smart contracts execute it without you lifting a finger. The integration of such technologies promises a more efficient and insightful trading experience鈥攖ransforming how 鈥渨hat鈥檚 Walmart stock trading鈥?becomes more than a question, but an actionable opportunity.

Walmart stock offers a blend of stability, liquidity, and adaptability. Traders can:

In today鈥檚 financial landscape, asking what鈥檚 Walmart stock trading isn鈥檛 just about the price鈥攊t鈥檚 about understanding its place in a broader market ecosystem. It鈥檚 about seeing how traditional equities intersect with cutting-edge tools, DeFi opportunities, and AI-driven insights.

Whether you鈥檙e a seasoned trader or exploring the market for the first time, Walmart stock represents both a familiar anchor and a gateway into innovative trading strategies. Take control, analyze smartly, and let advanced tools guide your way. After all, investing isn鈥檛 just about following trends鈥攊t鈥檚 about anticipating the future while staying grounded in reliable assets.

Walmart Stock: Stability Today, Smart Trading Tomorrow.

If you want, I can also create a visual web-friendly version with charts, asset comparisons, and trading tips to make it even more engaging for readers. Do you want me to do that next?