Ever thought about what it would be like to trade with someone else’s capital instead of risking your own? That’s the magic of prop trading firms. They’re like the venture capital of the trading world — they take a bet on your skill, not your bank account. In return, you get access to bigger accounts, better resources, and a shot at scaling up without drowning in risk. But not all prop firms are created equal, and names like FTMO, MyForexFunds, and The5ers lead the list for a reason.

Trading with a prop firm isn’t just about passing a challenge. It’s about finding one that matches your style, market focus, and risk appetite.

FTMO has built a reputation for professionalism, a clean onboarding process, and tight rules that force discipline. Their evaluation period feels almost like an audition — pass it, and you’re on stage with serious capital. MyForexFunds shook up the scene by offering faster scaling models and more flexibility, especially for traders who hated long evaluation phases. The5ers leans into the “slow and steady” mentality: they’ll give you real funded accounts from the start, but scale you gradually as you prove consistent.

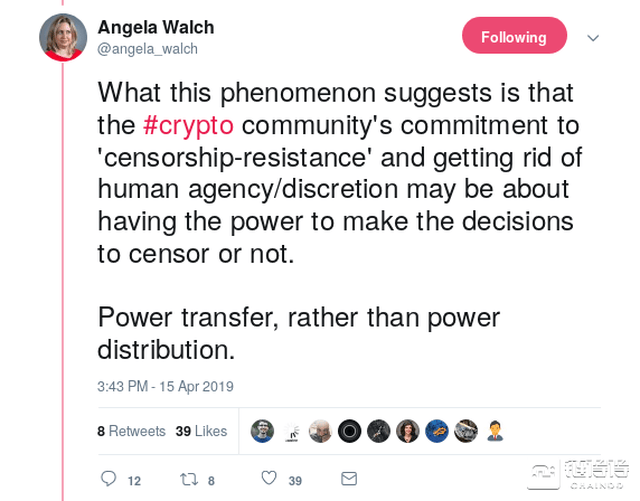

Then there are newer players experimenting with crypto-only models or combining multiple asset classes — forex, stocks, crypto, indices, options, commodities — under one roof. It’s not just about currencies anymore; diversified prop firms give traders more room to play in different arenas, which can be a double-edged sword for those who haven’t mastered cross-market strategies.

One thing that makes the top firms stand out is the education and community side of the deal. A good prop firm doesn’t just throw money at you; they monitor your trades and nudge you toward better habits. Think of it like making the leap from street basketball to the NBA — you get the structure, the analytics, the team spirit, and yes, the pressure.

In a world where decentralized finance (DeFi) is morphing into mainstream conversation, prop firms could soon start integrating blockchain audits, smart contract-based payouts, and AI-driven risk evaluation. Imagine a funding model where your trading performance is tracked on a blockchain, payouts are instant, and your risk profile is managed by an algorithm that learns your habits better than you do.

Not everything is smooth sailing. Prop trading is demanding, and some traders get crushed by the rules — maximum daily drawdowns, strict consistency targets, limited position sizes. These limits exist for survival, but they can trip up even skilled players. MyForexFunds saw explosive growth, but rapid expansion in a volatile sector comes with compliance headaches. FTMO’s reputation is rock-solid, yet their strict evaluation scares off impulsive traders. And while The5ers’ model is kind to patient traders, it might frustrate those who want to scale rapidly.

Regulations add another layer of complexity. Even with a global talent pool, firms have to adapt to different licensing requirements, payment gateways, and liquidity provider relationships. The decentralized finance trend means more opportunities, but also new hurdles — smart contract bugs, hacking risks, and the unpredictable behavior of crypto markets.

We’re already seeing AI-powered analytics pick apart our trades in real-time. The next leap could be AI-driven prop firms that select traders based not just on a performance challenge, but on behavior modeling. Your trading “DNA” might be scored like a credit rating. Pair that with smart contracts, and we could see instant scaling, automated capital allocation, or even cross-platform portfolios that trade multiple markets at once without manual execution.

It’s possible that five years from now, the line between a prop firm and a DeFi protocol will blur entirely. The firms that combine funding, AI-driven analytics, multi-asset flexibility, and decentralized payout systems will lead the charge.

If you’re disciplined and thrive under structured evaluation, FTMO might feel like home. If you want speed and flexibility, MyForexFunds could give you the runway you need. If you prefer gradual growth with real accounts from day one, The5ers will fit better.

The key isn’t just finding “the best” prop firm — it’s finding the one that matches your mindset, your strategy, and your tolerance for stress.

Slogan-style takeaway: "Trade big. Risk small. Let your skill do the heavy lifting." "From forex to crypto — your strategy, their capital." "Prop trading: where discipline becomes profit."