"Trade bold, trade smart — because in prop trading, survival is your ultimate edge."

Ever had that moment where your trade is running hot — and then suddenly, one market swing wipes out a week’s worth of gains? That’s exactly the kind of scenario prop firms are determined to avoid. If you’ve ever wondered why some traders thrive inside a prop firm while others get shut down after just a few sessions, it all comes down to one thing: the risk management rules they live by and the drawdown limits that quietly protect both the trader and the firm’s capital.

These aren’t just arbitrary restrictions. They’re the guardrails on a mountain road. Remove them and trading turns from strategic risk-taking into pure gambling. And when the firm’s money is on the line, they’re going to make sure you stay on the safe side of that curve.

Prop firms don’t exist to indulge your "all-in" Forex dreams. They’re in the business of scaling skilled traders, and risk rules are the filter. By setting structured guidelines — daily loss caps, maximum open risk per position, and overall account drawdown limits — they weed out traders who chase adrenaline instead of consistency.

Take a typical daily loss limit: it might be set at 5% of your allocated capital. Go over it, and trading stops for the day — sometimes permanently for that account. Sounds restrictive, right? But for a firm funding hundreds of traders across Forex, stocks, crypto, indices, options, and commodities, it’s basic risk arithmetic. One trader blowing up can’t be allowed to sink the ship.

Drawdown limits might feel like the annoying “speed limit” sign on a straight freeway, but they serve a purpose. Imagine you’re trading $100k in funded capital. The prop firm might set your max trailing drawdown at $10k. If your equity dips below $90k — whether from one bad day or death by a thousand cuts — you’re out.

Some firms use static drawdown (the limit doesn’t move up even if your account grows), while others apply trailing drawdown, locking in gains but still cutting you off if losses exceed the threshold. Both approaches train traders to preserve profits instead of riding market euphoria into a crash.

Risk rules aren’t just about avoiding disaster — they teach discipline. Forex traders learn to size positions carefully to survive volatility, stock traders develop patience in entry timing, crypto traders avoid the siren call of 20x leverage, and options traders learn how mispriced risk can erase an account overnight.

The smartest prop traders treat these rules not as handcuffs but as training wheels for bigger capital. Hit your targets month after month, and you could see your funding doubled, or gain access to new products and markets.

Think of it like the difference between backyard basketball and the NBA — the prop firm rulebook is what keeps the game professional.

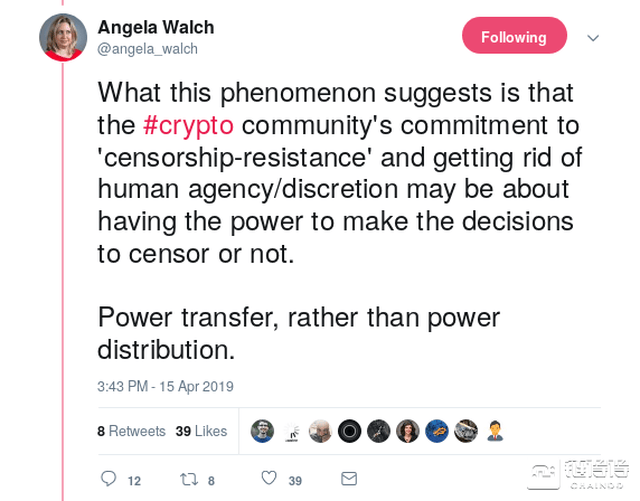

Things get even more interesting when you layer in DeFi. With decentralized exchanges, liquidity pools, and smart contracts, the speed and complexity of trades skyrocket. Prop firms experimenting in DeFi have had to adapt rules for flash loan risks, smart contract vulnerabilities, and unpredictable market events (remember Terra/LUNA?).

The challenge here is that traditional drawdown monitoring doesn’t always apply when trades are executed in milliseconds across algorithms. But those same principles — protect the capital, cap the loss — are being rebuilt into AI-driven monitoring systems and blockchain-based ledgers for transparency.

We’re heading toward a future where risk rules will be enforced in real time by AI, reacting faster than human managers to breaches in position limits. Smart contracts will auto-close trades when drawdowns hit preset levels, eliminating lag time and emotional hesitation.

For traders, this means opportunity — more capital access, wider asset range, instant execution — but also more pressure to operate with precision. The prop firm of tomorrow will be part fintech wizard, part risk psychologist.

Prop trading isn’t just about “being right” in the market — it’s about staying alive in it. Those risk management rules aren’t there to hold you back, but to give you the structure that makes scaling possible. In a $6.6 trillion-a-day Forex market, a crypto scene that never sleeps, and stock markets moving at algorithmic speed, risk discipline is the only way to turn skill into a career.

Tagline for the modern prop firm: “We don’t stop you from risking…it’s just that we make sure you live to risk another day.”