Trade Smart, Trade Real — Know the Gap Before You Leap.

Anyone who’s dipped their toes into forex trading knows the thrill of watching the chart climb in your favor… and the sinking feeling when it doesn’t. If you’ve ever started out on a demo account, you might remember the rush of seeing fake money grow without the fear of losing rent money. But switch to live trading, and suddenly your palms sweat, your heart races, and your decision-making changes. That’s not magic — that’s psychology, risk, and real stakes talking.

In a demo account, losses are just numbers on a screen, so traders tend to play bold. You’ll hold onto trades longer, take bigger positions, and treat stop-loss rules loosely because there’s zero consequence beyond a bruised ego. Live accounts flip that psychology upside down. Every pip gained or lost directly affects your actual balance, and the emotional weight of each decision is real. This often leads to over‑correction — cutting trades too early, freezing mid‑movement, or avoiding risks entirely.

A prop trading friend once told me, “Demo taught me the charts, live taught me myself.” That’s the sweet spot — understanding technicals is one half of the game, mastering your emotions is the other.

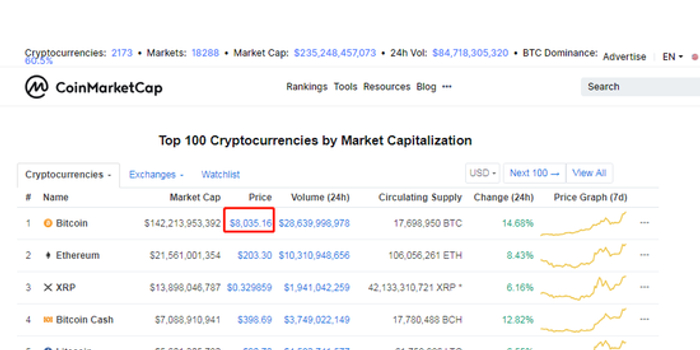

Demo accounts are fed with market data, but they don’t always replicate real execution conditions. Live trading deals with liquidity gaps, slippage during volatile moments, and unexpected spreads widening when news hits. In forex, these micro‑frictions change the outcome of a trade, especially for scalpers. If you move into stocks, crypto, indices, or commodities, these effects can be more pronounced — decentralized exchanges in crypto can add network delays, while commodities can spike unpredictably on geopolitical news.

Think of it like driving a car in a VR simulator versus on a real road. In VR, you can speed into a corner safely; in real life, the tires grip differently, the road might be wet, and there’s traffic to deal with.

It’s tempting to treat demo accounts as unlimited playgrounds — most platforms let you start with $50,000 or $100,000 in virtual funds, amounts you may never actually invest in reality. This gives a skewed sense of money management. Live accounts force you to respect your personal capital and understand position sizing that matches your actual capacity.

For prop traders — whether dealing in forex, stocks, crypto, or options — risk management is the skill that truly scales income. The firms backing traders don’t care how flashy your profits look in a demo; they care that you can protect capital under pressure.

Trading forex on demo helps sharpen the eye for chart patterns, but cross‑training with stocks, indices, crypto, and commodities adds resilience. For example:

A demo is perfect for exploring these landscapes without burning through your cash, but live trading is where execution speed, order accuracy, and adaptability matter.

Prop trading has carved a dynamic spot in the modern financial world. Decentralized Finance (DeFi) is introducing new order books and liquidity pools where traders can move capital without traditional brokers. While the transparency is appealing, challenges like smart contract vulnerabilities and liquidity fragmentation exist. AI‑driven trading systems are getting smarter, automating strategies and even reading sentiment from social media in real time.

For a trader transitioning from demo to live accounts today, staying adaptable is vital. Smart contracts are making instant margin adjustments possible. AI could next predict market conditions before traders react — an edge that magnifies when combined with disciplined risk control learned on live runs.

When you move from demo to live:

And if you’re in the prop trading world, consider live micro‑accounts as your bridge — real stakes but small enough to keep pressure manageable.

Slogan Hook: “In demo you learn the market. In live you learn yourself. Master both, and the profits will follow.”

Shifting from demo to live isn’t just about flipping a switch; it’s about preparing your mindset, controlling risk, and embracing the real‑world chaos the markets will throw at you. In a fast‑evolving industry with DeFi disruptions, AI trading, and multi‑asset opportunities, that gap between simulated and real trading is the step that defines careers.

Do you want me to also create a short, punchy SEO‑friendly meta description for this piece so it’s ready to go on a webpage?

Support Pollinations.AI: