“Trade smart, trade free — your profit, your pace.”

There’s a quiet revolution going on in the prop trading world. More and more firms are offering “funded accounts” with no time limit to hit your profit targets. On the surface, it sounds dreamy — no ticking clock, no pressure to rush trades just to pass a challenge. But let’s be honest, in the back of your mind there’s that nagging question: is this too good to be true? Or is it a legit shift in how traders can prove themselves and get access to capital?

A funded account is basically the prop firm saying, “Here’s our money; you trade it, and we split the profits.” You don’t risk your own funds but you do have to prove that you can trade responsibly and consistently. Most firms make you pass a challenge — hit certain profit targets without breaking drawdown rules — and traditionally, you have 30 days or less to do it.

No time limit changes that dynamic completely. You can pace yourself, wait for your setups, and treat it as a real trading environment instead of a speed test. For Forex scalpers, stock swing traders, crypto day traders, or even people dabbling in commodities or indices, the breathing room can make all the difference.

It’s not pure generosity. Reliable traders are valuable long-term assets. When a firm removes the time limit, they filter out the gamblers who only win when they’re lucky and keep the traders who can produce steady returns.

From the firm’s perspective:

Sometimes. “No time limit” doesn’t mean “no rules.” Drawdown limits, daily loss caps, and position sizing limits still apply. Some firms also have hidden policies — like monthly activity requirements — so it’s not truly unlimited. Always check the terms.

As a trader, I’ve seen people fail not because the firm was shady, but because they took “no time limit” as an excuse to procrastinate. Months go by, and they’ve barely placed a trade. That’s not trading; that’s camping.

We’re in a unique moment in finance:

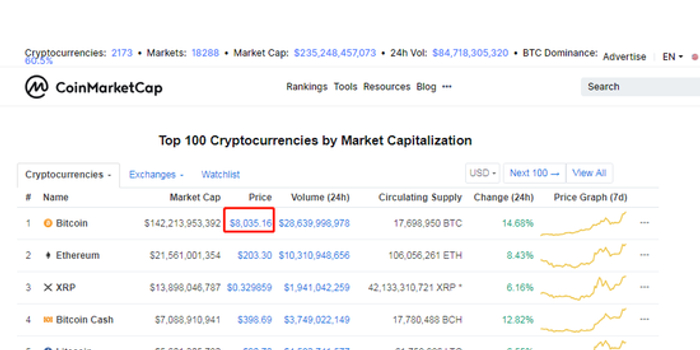

Prop trading without time limits plays perfectly into this — traders can run more diversified strategies without the artificial deadline pushing them into bad trades. Imagine blending traditional Forex with an ETH/BTC swing strategy, or pairing gold futures with NASDAQ index positions, all under one funded account.

Based on what’s out there, the serious firms offering no time limit funded accounts aren’t scams — they’re adapting to market realities. Scams are the ones with vague rules, disappearing phone numbers, and promises you’ll “be rich by Friday.” Legitimate firms make their money by having good traders trade well over a long period, not by catching you in mistakes.

The combo of no-time-limit prop accounts, AI-driven trade analysis, and decentralized settlement will probably define the next wave of retail trader opportunity. You could be trading Brent crude in the morning, shorting the S&P at lunch, and running a smart contract on Cardano by evening — all with firm capital.

The phrase to remember? “Your strategy, your clock — the market waits for no one, but your account can.”

So, no — funded accounts with no time limit aren’t automatically a scam. They might be the training ground where disciplined traders turn into serious portfolio managers. Just go in with clear eyes, a solid plan, and the understanding that time freedom is nothing without trade discipline.

If you want, I can also give you a sharp, clicky meta description for this article so it ranks well and pulls readers in. Want me to?